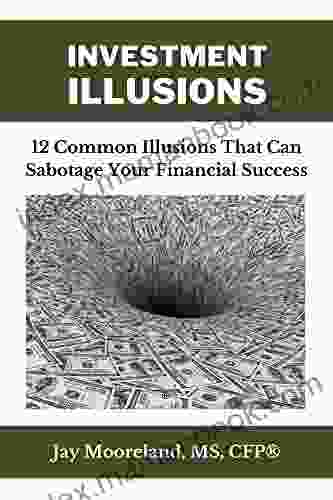

12 Common Illusions That Can Sabotage Your Financial Success

5 out of 5

| Language | : | English |

| File size | : | 4804 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 158 pages |

| Lending | : | Enabled |

Financial illusions are incorrect beliefs or assumptions about money and wealth that can lead to poor financial decision-making. These illusions can prevent us from achieving our financial goals and can even sabotage our financial security. It is important to be aware of these illusions so that we can break free from them and make sound financial decisions.

1. The Illusion of Control

The illusion of control is the belief that we have more control over our financial situation than we actually do. This illusion can lead us to make risky investments or take on too much debt. It can also make us overestimate our ability to save for the future.

How to break free: Recognize that there are many factors that affect our financial situation that we cannot control, such as the economy, interest rates, and market fluctuations. Focus on what you can control, such as your spending habits, saving rate, and investment strategy.

2. The Illusion of Knowledge

The illusion of knowledge is the belief that we know more about financial matters than we actually do. This illusion can lead us to make poor investment decisions or to underestimate the risks involved in certain financial products.

How to break free: Be honest with yourself about your financial knowledge and experience. If you are not sure about something, do some research or consult with a financial advisor. Remember that there is always something new to learn about finances.

3. The Illusion of Safety

The illusion of safety is the belief that our money is safe if we keep it in a traditional bank account or under our mattress. This illusion can lead us to overlook the risks of inflation and market fluctuations.

How to break free: Diversify your investments across different asset classes, such as stocks, bonds, and real estate. This will help to reduce your risk of losing money if one asset class performs poorly.

4. The Illusion of Certainty

The illusion of certainty is the belief that we can predict the future with certainty. This illusion can lead us to make investment decisions based on past performance or on tips from friends or family. However, the future is always uncertain, and there is no guarantee that past performance will continue.

How to break free: Invest for the long term and do not try to time the market. Diversify your investments and rebalance your portfolio regularly. This will help to reduce your risk of losing money if the market takes a downturn.

5. The Illusion of Scarcity

The illusion of scarcity is the belief that there is not enough money to go around. This illusion can lead us to be stingy with our spending and to save too little for the future. It can also make us feel anxious about our financial situation.

How to break free: Recognize that there is enough money to go around for everyone. Focus on earning more money and saving more. Remember that you can always increase your income or find ways to save more.

6. The Illusion of Success

The illusion of success is the belief that we are ng well financially because we have a high income or a lot of assets. This illusion can lead us to spend too much and to take on too much debt. It can also make us overestimate our net worth.

How to break free: Track your income and expenses, and create a budget. This will help you to see where your money is going and to avoid overspending. Remember that net worth is not the same as income, and that it is important to build up your assets and reduce your debt.

7. The Illusion of Failure

The illusion of failure is the belief that we will never be able to achieve financial success. This illusion can lead us to give up on our financial goals and to settle for a life of financial mediocrity. It can also make us feel hopeless and discouraged.

How to break free: Challenge your negative thoughts about money and wealth. Focus on your strengths and on the things that you can control. Set realistic financial goals and take small steps to achieve them. Remember that everyone makes mistakes, and that it is never too late to turn your financial situation around.

8. The Illusion of Comparison

The illusion of comparison is the belief that we are not ng well financially because we compare ourselves to others. This illusion can lead us to feel inadequate and to make poor financial decisions. It can also make us resentful of others who are more successful than we are.

How to break free: Stop comparing yourself to others. Focus on your own financial journey and set goals that are realistic for you. Remember that everyone is different, and that there is no one-size-fits-all approach to financial success.

9. The Illusion of Time

The illusion of time is the belief that we have plenty of time to achieve our financial goals. This illusion can lead us to procrastinate and to put off saving and investing. It can also make us feel like we are not making any progress toward our goals.

How to break free: Set short-term and long-term financial goals. Create a plan and take action to achieve your goals. Remember that time is precious, and that it is important to start saving and investing early.

10. The Illusion of Effort

The illusion of effort is the belief that we have to work hard to achieve financial success. This illusion can lead us to overwork ourselves and to neglect our health and relationships. It can also make us feel like we are not good enough if we do not achieve our financial goals quickly.

How to break free: Remember that financial success is a marathon, not a sprint. Focus on making small, consistent changes to your financial habits. Be patient and persistent, and do not give up on your goals. Find ways to make your financial journey enjoyable, and do not be afraid to ask for help when you need it.

11. The Illusion of Luck

The illusion of luck is the belief that financial success is a matter of luck or chance. This illusion can lead us to blame our financial problems on external factors and to give up on our financial goals. It can also make us feel like we are not in control of our financial situation.

How to break free: Recognize that financial success is not a matter of luck. It is the result of hard work, planning, and perseverance. Focus on the things that you can control, and do not let setbacks discourage you. Remember that everyone experiences setbacks, and that it is how we respond to them that matters.

12. The Illusion of Self-Fulfillment

The illusion of self-fulfillment is the belief that financial success will make us happy and fulfilled. This illusion can lead us to pursue money and wealth at the expense of our health, relationships, and personal values. It can also make us feel like we are not good enough if we do not achieve financial success.

How to break free: Define what financial success means to you. Focus on your values and on what is important to you in life. Remember that money is not the only measure of success, and that there are many other things that can bring us happiness and fulfillment.

Financial illusions can sabotage our financial success if we are not aware of them. By breaking free from these illusions, we can make sound financial decisions and achieve our financial goals. Remember that financial success is not a one-size-fits-all approach. It is a personal journey that requires us to be honest with ourselves, to set realistic goals, and to take action.

5 out of 5

| Language | : | English |

| File size | : | 4804 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 158 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue D T Adams

D T Adams Moira Rose Donohue

Moira Rose Donohue Jane Bluestein

Jane Bluestein Tamara Grantham

Tamara Grantham Kenneth J Fasching Varner

Kenneth J Fasching Varner Natasha Quadlin

Natasha Quadlin Levi A Reed

Levi A Reed Nikki Haverstock

Nikki Haverstock Nicole Galland

Nicole Galland Amy Cornwell

Amy Cornwell Alan Christianson

Alan Christianson Jerry Mintz

Jerry Mintz Rose Sinclair

Rose Sinclair Jennifer Polimino

Jennifer Polimino Phyllis Good

Phyllis Good Everett Ellenwood

Everett Ellenwood Charles Evans

Charles Evans Ja Andrews

Ja Andrews William A Smith

William A Smith Otm Author Services

Otm Author Services

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Matthew WardA Literary Exploration of Alta Mabin's Farm Alarm Poems: A Blend of Nature,...

Matthew WardA Literary Exploration of Alta Mabin's Farm Alarm Poems: A Blend of Nature,... José SaramagoFollow ·6.7k

José SaramagoFollow ·6.7k Bret MitchellFollow ·9.1k

Bret MitchellFollow ·9.1k Braden WardFollow ·15.4k

Braden WardFollow ·15.4k Leslie CarterFollow ·4.4k

Leslie CarterFollow ·4.4k Cruz SimmonsFollow ·13.9k

Cruz SimmonsFollow ·13.9k Clark CampbellFollow ·9.4k

Clark CampbellFollow ·9.4k Richard AdamsFollow ·4.3k

Richard AdamsFollow ·4.3k Nikolai GogolFollow ·14.6k

Nikolai GogolFollow ·14.6k

Dwight Bell

Dwight BellSlightly Higher Interval Training For 5k Runners: A...

Interval training has become an...

Jordan Blair

Jordan BlairLazarillo de Tormes and the Swindler: A Tale of Deception...

The story of Lazarillo de...

Grayson Bell

Grayson BellDelphi Complete Works Of James Thomson Illustrated Delphi...

: Unveiling the...

Cooper Bell

Cooper BellAssessment For Learning (UK Higher Education OUP...

Assessment plays a crucial role in higher...

Luke Blair

Luke BlairThis Is How Knew: A Comprehensive Guide to Unlocking Your...

Have you ever wondered if...

Forrest Blair

Forrest BlairExploring the Kingdom of the Blind: A Deep Dive into an...

The Kingdom of the...

5 out of 5

| Language | : | English |

| File size | : | 4804 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 158 pages |

| Lending | : | Enabled |