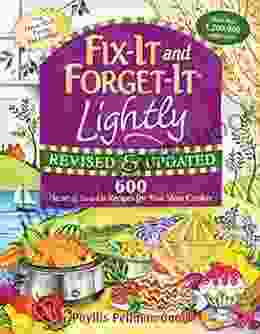

Fix It and Forget It Lightly Revised Updated: A Comprehensive Guide to Long-Term Investing

4.5 out of 5

| Language | : | English |

| File size | : | 7416 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 903 pages |

| Lending | : | Enabled |

In the realm of personal finance, few books have had a lasting impact like "Fix It and Forget It." First published in 1998, this investing guide has sold over a million copies and revolutionized the way many Americans think about long-term wealth building.

The core premise of "Fix It and Forget It" is remarkably simple: create a diversified portfolio of low-cost index funds and hold it for the long haul, regardless of market fluctuations. This approach, pioneered by author and financial advisor Philip Fisher, has been shown to consistently outperform active management strategies over extended periods of time.

Over the years, Fisher has revised and updated "Fix It and Forget It" to reflect changes in the financial landscape. The latest edition, "Fix It and Forget It Lightly Revised Updated," contains updated recommendations on asset allocation, fund selection, and rebalancing strategies.

In this comprehensive guide, we will explore the key principles of "Fix It and Forget It," highlight the updates in the latest edition, and provide practical guidance on how to implement this investing strategy in your own financial plan.

The Principles of Fix It and Forget It

The "Fix It and Forget It" philosophy is based on the following principles:

- Invest in low-cost index funds. Index funds are passively managed funds that track a specific market index, such as the S&P 500. They offer low fees and broad diversification, which can significantly improve your investment returns over time.

- Diversify your portfolio. Diversification is the key to reducing risk in your investment portfolio. By investing in a variety of asset classes, such as stocks, bonds, and real estate, you can minimize the impact of any one asset class underperforming.

- Rebalance your portfolio regularly. As your investments grow, the asset allocation of your portfolio will naturally change. Periodically rebalancing your portfolio will ensure that your asset allocation remains aligned with your risk tolerance and investment goals.

- Stay the course. The stock market is inherently volatile. There will be times when the market experiences significant fluctuations. However, it is important to remember that over the long term, the stock market has always trended upward. By staying the course and avoiding the temptation to panic sell, you can maximize your investment returns.

Updates in Fix It and Forget It Lightly Revised Updated

The latest edition of "Fix It and Forget It" contains a number of updates, including:

- New recommendations on asset allocation. Fisher now recommends a more conservative asset allocation, with a greater emphasis on fixed income investments. This reflects his belief that the stock market is likely to experience lower returns in the coming years.

- Updated fund recommendations. Fisher has updated his recommendations on specific index funds. He now recommends funds that offer lower fees and broader diversification.

- New guidance on rebalancing strategies. Fisher provides more detailed guidance on how to rebalance your portfolio, including specific target asset allocations for different age groups.

- Expanded discussion of behavioral finance. Fisher discusses the psychological biases that can lead investors to make poor investment decisions. He provides practical tips on how to overcome these biases and make more rational investment decisions.

How to Implement the Fix It and Forget It Strategy

Implementing the "Fix It and Forget It" strategy is relatively straightforward. Here are the steps you need to take:

- Determine your risk tolerance. Your risk tolerance is the amount of risk you are comfortable taking with your investments. There are a number of factors that can affect your risk tolerance, such as your age, investment goals, and financial situation.

- Choose an asset allocation. Based on your risk tolerance, you need to choose an asset allocation that determines the percentage of your portfolio that will be invested in different asset classes, such as stocks, bonds, and real estate.

- Select index funds. Once you have chosen an asset allocation, you need to select specific index funds to invest in. There are a number of different index funds available, so it is important to do your research and choose funds that meet your investment goals and risk tolerance.

- Rebalance your portfolio regularly. As your investments grow, the asset allocation of your portfolio will naturally change. You should rebalance your portfolio periodically to ensure that your asset allocation remains aligned with your risk tolerance and investment goals.

"Fix It and Forget It Lightly Revised Updated" is a valuable resource for anyone who is interested in long-term investing. The book provides clear, concise, and actionable advice on how to build a diversified portfolio of low-cost index funds and hold it for the long haul. By following the principles outlined in this book, you can increase your chances of achieving your financial goals.

However, it is important to remember that investing involves risk. The stock market can be volatile, and there is no guarantee that your investments will always grow. Before you invest, you should carefully consider your investment goals and risk tolerance. You should also seek the advice of a qualified financial advisor to ensure that your investment strategy is aligned with your individual circumstances.

4.5 out of 5

| Language | : | English |

| File size | : | 7416 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 903 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Alex Bledsoe

Alex Bledsoe Jay Mooreland

Jay Mooreland Zane Dowling

Zane Dowling Paul Black

Paul Black Patricia S Lemer

Patricia S Lemer Kevin Mclaughlin

Kevin Mclaughlin Monica Boothe

Monica Boothe Shannon Baker

Shannon Baker Annette M Watts Vilas Boas

Annette M Watts Vilas Boas Peter Cawdron

Peter Cawdron Leonida Reyes

Leonida Reyes Alec Sheppard

Alec Sheppard Katherine Grace

Katherine Grace John Dean

John Dean Daniel Paul Gilbert

Daniel Paul Gilbert Nikki Haverstock

Nikki Haverstock David Page

David Page Dominique Davis

Dominique Davis Sarah Raymond Herndon

Sarah Raymond Herndon Christina Hyun

Christina Hyun

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Isaac BellFollow ·14.1k

Isaac BellFollow ·14.1k Hassan CoxFollow ·16.1k

Hassan CoxFollow ·16.1k Oscar WildeFollow ·13.4k

Oscar WildeFollow ·13.4k Mario SimmonsFollow ·12.1k

Mario SimmonsFollow ·12.1k Eliot FosterFollow ·17.1k

Eliot FosterFollow ·17.1k Andres CarterFollow ·19.6k

Andres CarterFollow ·19.6k Adrien BlairFollow ·12.3k

Adrien BlairFollow ·12.3k Sidney CoxFollow ·2.7k

Sidney CoxFollow ·2.7k

Dwight Bell

Dwight BellSlightly Higher Interval Training For 5k Runners: A...

Interval training has become an...

Jordan Blair

Jordan BlairLazarillo de Tormes and the Swindler: A Tale of Deception...

The story of Lazarillo de...

Grayson Bell

Grayson BellDelphi Complete Works Of James Thomson Illustrated Delphi...

: Unveiling the...

Cooper Bell

Cooper BellAssessment For Learning (UK Higher Education OUP...

Assessment plays a crucial role in higher...

Luke Blair

Luke BlairThis Is How Knew: A Comprehensive Guide to Unlocking Your...

Have you ever wondered if...

Forrest Blair

Forrest BlairExploring the Kingdom of the Blind: A Deep Dive into an...

The Kingdom of the...

4.5 out of 5

| Language | : | English |

| File size | : | 7416 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 903 pages |

| Lending | : | Enabled |